Emergence of algorithmic underwriting in Specialty insurance.

Author: Adam Mesout

Senior Algorithm Analytics Manager, Ki

Progression of underwriting

It was very natural for early insurers to want a comprehensive understanding of what they were insuring. This information was key in deciding pricing and better utilisation of these factors was almost certainly a competitive advantage for an underwriter. However, the complexity of how these are used to predict impacts on claims has likely advanced far beyond what early underwriters would have thought possible.

This new depth comes with its own challenges, juggling all of the components that underpin what decision to make can be challenging and sometimes inconsistent.

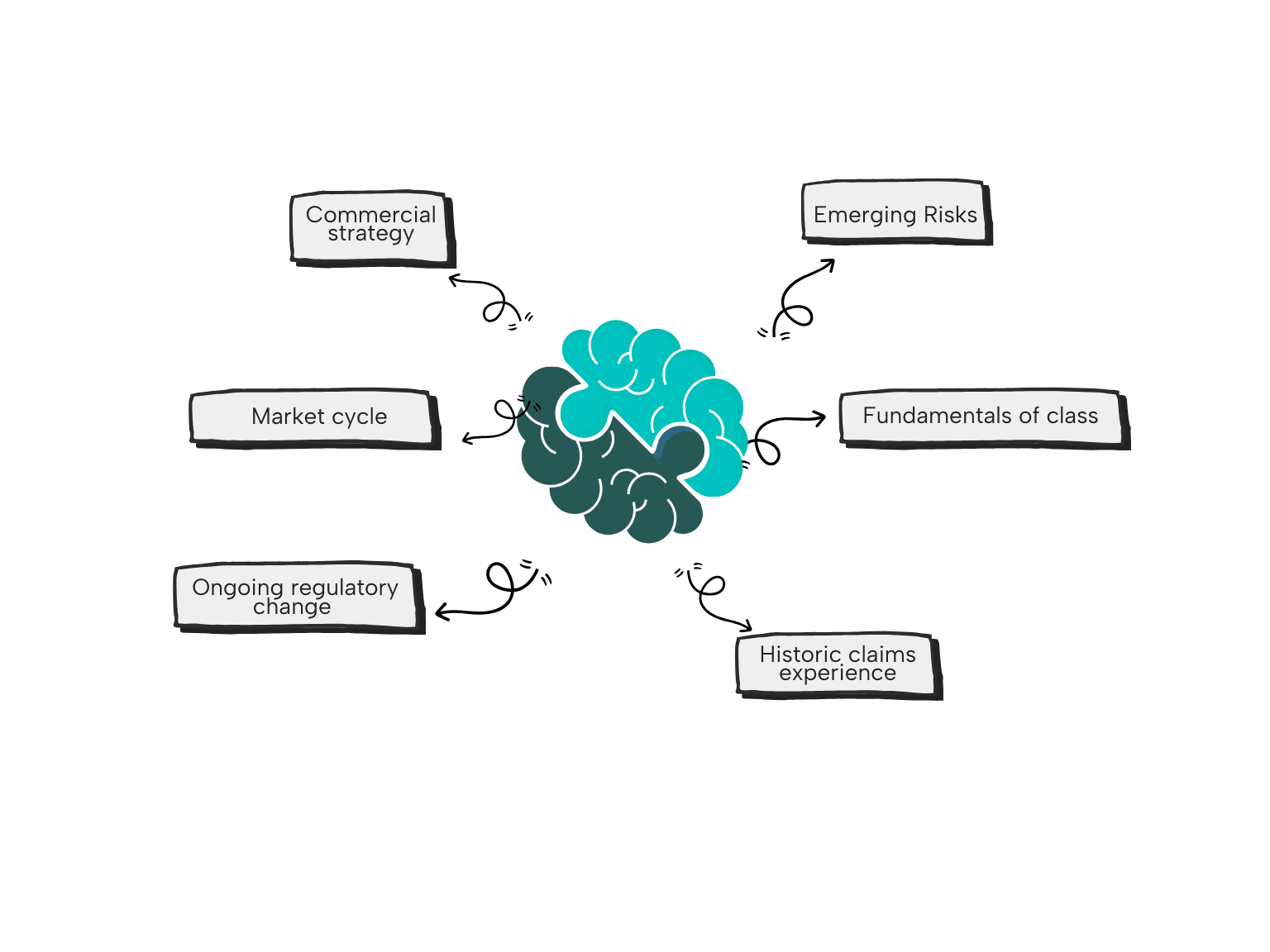

Figure 1 – an example of the internal decision making when a human being is assessing a risk

These components are split between learned experience and expert judgement. Modelling and prediction pairs naturally behind the data driven components such as claims experience, but human beings are central in overlaying insights for which there is no structured data.

If a modelled view of a risk conflicts with these broader objectives or insights, then it is the human in the loop who ultimately has the task of balancing these priorities and making a final decision.

Introduction of algorithmic underwriting

As sophistication of both data and tech improves, we can extend digital capability beyond just learning from claims experience and also introduce algorithmic management of more components.

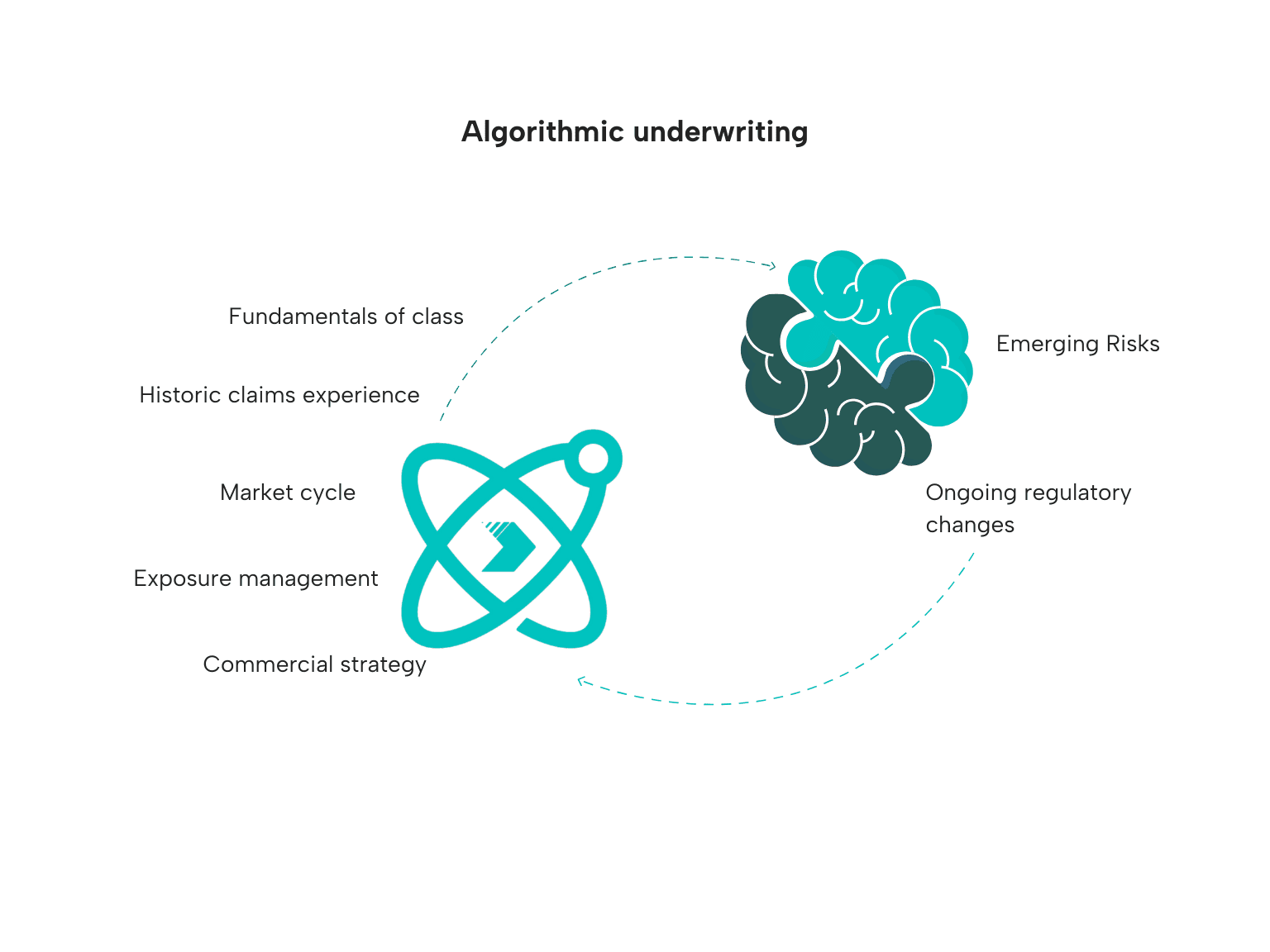

Figure 2 – an example of how the roles in human underwriting can be shared with algorithmic capability

With less energy spent on balancing priorities that can be managed digitally, human insights can be better utilised where there is increased need for it. Similarly, as the number of decisions which involve a human decrease, the time taken to provide a view on a risk decreases. This drives faster response times for brokers, and ultimately clients.

How does digitally enhanced underwriting work effectively

Amongst other things, Ki utilises these three tenets to maintaining harmony between digital and human decision making:

Understanding of data credibility

Ki’s algorithm is aware of the quality of the data behind its assessments and takes this into account during decision making. Doing this ensures confidence in our judgement, but also encourages scalability as we expand the data that exists in the background.

Seamless integration of digital and human decision making

Despite being a complex digital product, the Algorithm is designed in a way that is easily interpretable by human beings. This enables the combination of external judgement with the trends and pattern from the data. In this model, we can be confident that human driven underwriting decisions do not violate any other requirement when writing risks – controls for components such as aggregation are considered on the same playing field as our risk assessment.

Continual improvement

Each class has its own complexities, whether they be fundamental to the class or related to difficulties in data presence. Iterating at a class-by-class basis, expanding to new sources of data and adapting the algorithm for fundamentals maximises the value that both digital and human decision making can make.

What’s next?

This is just a point in time report on what’s possible – every few years it seems we have our perspective of what we can do with technology completely changed. With the massive development of GenAI over the past few years, new tools offer the abilities to extract unstructured data to expand historic datasets, easily create data from reports on current events and more. This gives us access to a cornucopia of information to better refine our models and identify new signals.

This is especially exciting for Ki, where we are currently leveraging this technology to expand the amount of data we can get from brokers using our platform, without any additional effort. This improves our ability to underwrite risks, without jeopardising the broker experience.

Not only that, but the type of information we can leverage is also changing. Every time a human provides insight whilst underwriting today, they are generating new data. In the not-too-distant future there is the possibility of using this data directly, to train a model which monitors for the need for human interaction. This could then proactively reach out for direct human insight where necessary – a concept which is certainly unfathomable to an underwriter 300 years ago.

Efficient. Data Driven. Innovative. Fast.