Alan Tua

Managing Director, Technology

Ki Series / 12th Sep 2023

Managing Director, Technology

The Lloyd’s of London insurance market is a large-scale complex system with interactions between actors (called agents) such as brokers, syndicates, reinsurers, and capital providers. In our recent preprint, available now on arXiv, we present an agent-based simulation of the Lloyd’s of London insurance market. This proof-of-concept model allows us to simulate various what-if scenarios that capture important market phenomena such as the underwriting cycle, the impact of risk syndication, and the importance of appropriate exposure management.

In an agent-based model, a system is modelled as a collection of autonomous decision-making entities called agents that interact with each other and the environment. This contrasts with many traditional economic models that assume all agents are the same and behave in the same, rational way. An agent-based approach allows us to explicitly model the heterogenous characteristics and behaviour between agents, which can capture the complexity of real-world systems more accurately.

For example, in the context of the Lloyd’s of London market, different insurers and reinsurers have different risk appetites, underwriting strategies and capital structures. By representing each of these agents as a unique entity with their own beliefs, desires and intentions, we can better capture the diversity of the market and the interactions between agents that drive market dynamics.

Our model is built with the HADES Asynchronous Discrete Event Simulation (HADES), a Python framework for creating event-based simulations. HADES has been open-sourced by Ki and is available on PyPI here.

Within a syndicate, there are many processes and data sources involved in underwriting a risk. We have distilled these down to three initial components for simplicity:

Actuarial pricing uses risk data and loss experience to determine the fair price of a policy to cover expected losses over its lifetime.

Using recent market pricing conditions and syndicate’s past performance to determine the target markup.

Incorporating information about the current portfolio and available capital allows syndicates to better manage their tail risk.

We have designed our model to be modular so that we can rapidly prototype and experiment with different agent behaviours. This allows us to segment the different contributions and inspect how they each behave over time during a simulation. In our proof-of-concept results, agents can adapt to the underlying loss-generating process and update their pricing. They are also able to make decisions based on their current portfolio to avoid writing too much risk.

While currently simplistic, this demonstrates the flexibility of our approach and serves as a foundation to incorporate further behavioural complexity in future works. An area of research interest is quantifying the impact of relationships between brokers and syndicates. Another is explicitly modelling the impact of business planning and capacity during a year.

Large industry losses from natural catastrophes are known to reduce capital availability and cause insurance premium rates to increase. To incorporate this in our model, we have developed an interface for stochastic events to affect many risks. This allows us to investigate the transient market-level behaviour because of major losses induced by catastrophe events. In our experiments, we have found these large losses can generate more realistic market cyclicality. Our next steps involve calibrating the model to real catastrophe data, including historical events and simulations of potential future scenarios.

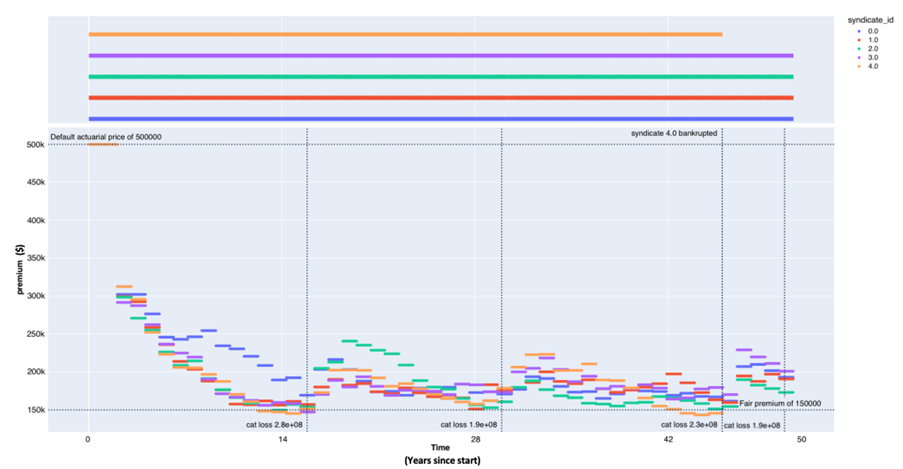

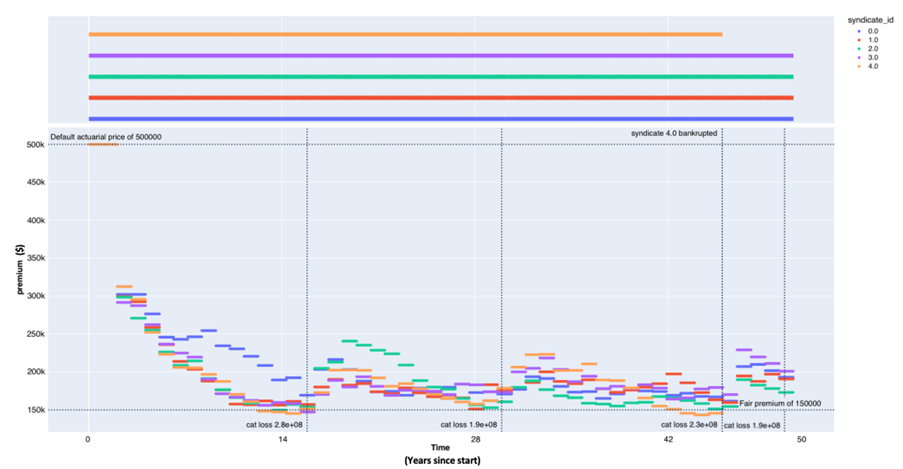

See below for illustrative examples of an uncalibrated model run with catastrophe losses (vertical annotations) resulting in underwriting cycles.

This figure shows catastrophe events cause step drops in syndicate capitals.

This figure shows premium rates offered by syndicates increase shortly after large losses but soften over time.

Risk syndication is a core feature of the Lloyd’s of London market that sets it apart from many other insurance markets. It refers to the practice of multiple insurers pooling their financial resources to share the risk of a particular policy. This allows individual insurers to take on larger risks than they would be able to on their own, while still diversifying their portfolio and minimizing their exposure to any single event. Despite its importance, risk syndication has not been extensively modelled in agent-based modelling (ABM) literature. Our results mimic the fact that syndication drives down the volatility of the market. Moving forward, we plan to incorporate more sophisticated modelling of risks, including separate classes for different types of risks.

In this blog post, we have presented a proof-of-concept agent-based model of the Lloyd’s of London insurance market. Our simple model allows us to simulate various what-if scenarios that capture important market phenomena such as the underwriting cycle, the impact of risk syndication, and how exposure management influences syndicate performance in a cycle. By representing each agent as a unique entity with its own beliefs, desires and intentions, we can better capture the diversity of the market and the interactions between agents that drive market dynamics. Overall, our model serves as a foundation for further research and development in insurance market modelling.

This project is supported by Ki Insurance and The Alan Turing Institute via the Accenture Turing Partnership.