Differentiating algorithm underwriting from smart follow.

Author: James D’Souza

Staff Algorithm Engineer, Ki

At Ki, we believe that the future of the Lloyd’s follow market is going to be Algorithmic Underwriting; we believe that it is possible to outperform the market both in terms of underwriting result and expense ratio, and that this will lead to a more efficient, and more competitive London market.

“Across the London market, there are a variety of smart-follow models. These range from Active Portfolio Trackers; vehicles which track outperforming books via quota shares and consortia, through to Augmented Underwriting; human underwriters who are supported by a range of data-driven tools and algorithms.

The model that Ki takes is what we call “Algorithmic Underwriting”, where we are taking a data-driven approach and applying the best of both the insurance world and cutting-edge data science to fully automate the decision-making process.”

The core tenets of our approach to Algorithmic Underwriting are:

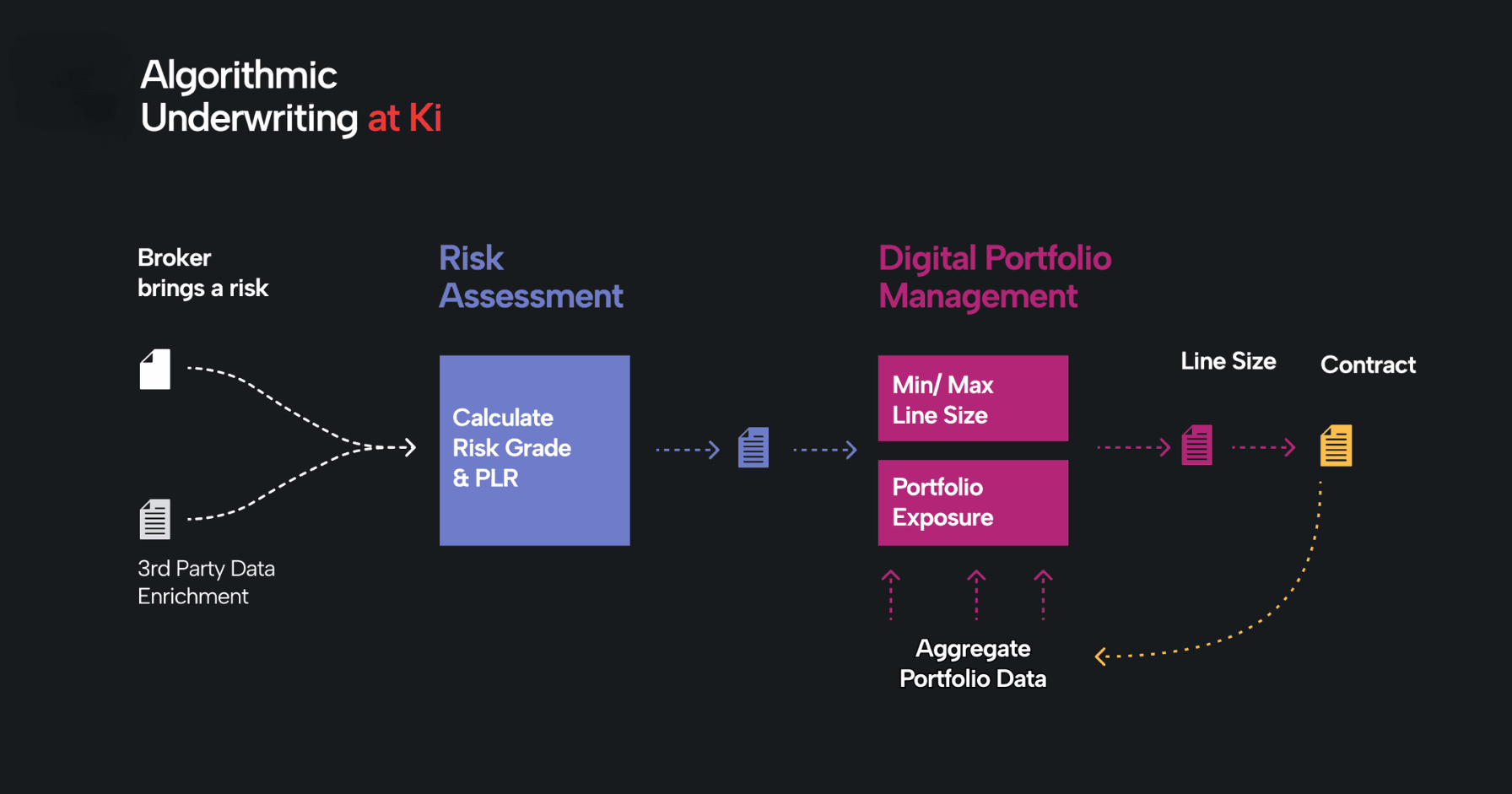

- Risk assessment – generating metrics which tell us about the quality of an individual risk.

- Real-time portfolio management – generating a line size by trading off various different considerations which tell us about the risk, our portfolio, and the commercial landscape.

As explored in detail in [Emergence of Algorithmic Underwriting in Specialty Insurance], these two steps are developed through close collaboration across multiple teams and are built to allow us to adjust our decisions based on the insights provided by our underwriters, exposure and portfolio management, and actuarial teams.

We have invested heavily into our infrastructure, meaning that our algorithm is at the heart of everything that we do, and it can be worked on by both technologists and specialty market experts. The ability to automate these two parts of the underwriting process are a key differentiator between us and other types of fast follow.

“It’s important to note here that our decision-making process is entirely automated – After clicking the “Get Quote” button on our website, our Algorithmic Underwriting engine will perform the two steps mentioned above and return a line size without any intervention from an underwriter in under 10 seconds*. These two steps mean that we are also adjusting the line size we put out based on both information about the risk and the current state of our portfolio; and in this sense, we don’t consider ourselves a pure market tracker.”

*Between 01/06/24 and 01/12/24 the average time it took for the Ki algorithm to return a quote was 6.02 seconds.

Risk assessment

Our Risk Assessment stage is tailored to each class of business; we use a combination of data science and actuarial approaches, depending on what data we have available for both prior years and at the point we are generating a quote. We take both trends from historical data and expert judgement into account to develop this stage of our underwriting process.

This stage outputs a series of metrics which are used to determine the expected profitability of a risk, which is used in the next stage to determine our line size.

We believe that by utilising both data and expert judgement in order to determine a view of the quality of each and every risk that comes to our platform, we have a significant edge over tracker syndicates.

Digital portfolio management

Once our Risk Assessment stage has given us metrics related an individual policy, we decide what line size to give based on those metrics, the current view of our portfolio, and some constraints.

As the line sizes we offer feed directly back into our aggregate portfolio data, we are able to adjust our line sizes based on real-time information about our aggregate book.

The constraints act as controls which allow us to let our algorithms make decisions with confidence. We often use the phrase “credibility drives flexibility” to describe our approach to making changes here; as we get more confident in our algorithms, we are able to give them more flexibility on our final line size decisions.

Benefits of algorithmic underwriting

We believe that “Algorithmic Underwriting”, our digitally enabled, data-driven approach, can create significant competitive advantage within Lloyd’s by virtue of scalable and robust risk selection, a better-connected insurance organisation and the ability to test, learn and evolve at pace. Through this approach, we are also bringing a significant amount of new technical talent into the market.

For the market as a whole, we believe that Algorithmic Underwriting can lead to a more efficient market; both in terms of pure expense ratio, and in the sense of the “efficient market hypothesis”.

By building a digital product, we are investing into our future; each incremental improvement we make to our platform and algorithms provides us value into the future. We believe that investing into technology means that we will be able to scale efficiently in a way that less technologically enabled competitors can’t.

Data-driven approaches are objective and aim to reduce biases and emotions as far as possible. By utilising these approaches more widely, we believe we can follow the lead of the investment world, enabling the market as a whole to become more informed, with better pricing and decision-making.

Efficient. Data Driven. Innovative. Fast.